Is the U.S. due for a recession or not? A case can be made either way

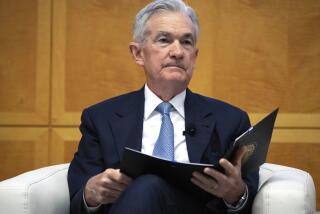

For the Federal Reserve, Wednesday’s decision to stand pat on interest rates wasn’t hard -- not with global financial markets and oil prices in turmoil.

But the Fed, like most everyone else, is finding itself trying to see past an impenetrable fog.

Some economists warn that the U.S. economy could fall into recession in the months ahead. If they’re right, a Fed campaign to keep notching up interest rates to slow the economic engine could tip the country over the cliff.

See more of our top stories on Facebook >>

But wait. A great many other economists -- probably a majority -- say the country is in no immediate danger of sliding into recession. If that’s true, the Fed can safely keep easing back on the throttle and reduce the danger of future inflation.

Who is right, the pessimists or the optimists? A lot is riding on the answer, and not just for investors. An economic downturn this year would be a powerful blow to Democratic hopes of holding onto the presidency in November’s election.

Alas for the Fed’s decision-makers, there’s no way to tell for sure.

Both sides have good arguments, and the central bank has no crystal ball to look into the future and see what’s ahead.

The pessimists point out that the current recovery has already lasted 10 months longer than the average period of uninterrupted growth since World War II.

And even though it’s still growing, the recovery from the Great Recession that began in mid-2009 -- never anything like a real boom -- looks increasingly fragile. Friday’s report on U.S. gross domestic product is expected to show fourth-quarter total economic output grew, at most, a measly 1% annualized.

So far, the U.S. has largely shrugged off the dramatic fall of China’s stock market and the far more troubling slowdown in China’s overall growth. But critics wonder: How much longer can America fight the odds? Isn’t the recovery bound to succumb to age and headwinds from overseas? And sooner rather than later?

“It’s kind of like a cold,” said Nayantara Hensel, former chief economist for the U.S. Navy. “You’ve got somebody sneezing and sick as a dog, and all the other countries are in the room together.” She put the odds of a U.S. recession this year at 50%.

One important sign of potential trouble ahead -- U.S. industrial output -- is slowing down. That’s bad news not only because it signals weaker sales and profits for manufacturers, but also shorter hours and smaller paychecks for their relatively well-paid workers.

Also, the world faces a glut of oil, and prices are almost in free-fall. Crude oil prices have plunged to about $30 a barrel from more than $110 in June 2014.

That’s good news for Americans at the gas pump. But it’s devastating for U.S. oil producers – and for the millions of businesses and workers tied to the oil industry.

“We’re going to find out just how diversified we are,” said Patrick Jankowski, an economist at the Greater Houston Partnership, noting that the metro area eked out 23,000 job gains last year, less than one-fourth the previous year.

If these warning signals are indeed flashing, economists who think the chances of a near-term recession are low have powerful arguments on their side too.

First, they note that age is not always a good indicator of economic durability or longevity. The expansion in the early 1990s lasted more than 10 years.

“Expansions don’t die of old age,” said Lynn Reaser, a longtime California economist who is chief economist for Point Loma Nazarene University in San Diego. Reaser says the risks of recession are significantly higher today than three months ago, primarily because of financial markets and China’s slowdown.

But she still doesn’t see a downturn around the corner. Job growth nationwide has been resilient, companies haven’t stockpiled goods, and government spending on the whole is increasing again.

“This [expansion] has been abnormally slow, frustrating in many respects,” she said, “but it also means we haven’t built up imbalances.”

Interviews with bellwether businesses such as temporary-help firms show a split picture.

“I think people are kind of stuck at the moment. We want to plan for growth, but there’s a lot of noise out there,” said Amit Pal Singh, director of operations at Labor Finders International, one of the nation’s largest industrial staffing firms.

In contrast, Tammy Browning, who shuttles between Philadelphia and the San Francisco Bay Area as senior vice president for the white-collar staffing firm Yoh, said: “We’re not seeing any pause button being pushed.”

I think people are kind of stuck at the moment. We want to plan for growth, but there’s a lot of noise out there.

— Amit Pal Singh, director of operations at Labor Finders International

Measures of consumer confidence, an important sign of future personal spending, have slipped a little from early last year but are holding firm, even during the last couple of weeks of plunging stocks.

“The [latest] data on consumer confidence does not indicate an impending recession,” said Richard Curtin, the survey’s director, although he noted that the final January measure will be released Friday.

Meanwhile, payroll job growth, rather than shrinking, has gained momentum lately. And this is probably the single biggest reason many economists are betting that the U.S. will avoid a recession this year. Job growth is at the heart of consumer confidence and spending, which accounts for about two-thirds of American economic activity.

Even with very little hiring by manufacturers, the U.S. added a strong 2.7 million net new jobs last year, and that came after an increase of 3.1 million payroll jobs in 2014. What’s more, employment growth accelerated in the fourth quarter.

Economists don’t see employers maintaining that pace of hiring, especially with the nationwide unemployment rate at 5%. And some experts think that the employment report for January, to be released Feb. 5, could mark a turning point in job growth.

While the worst of job cuts typically happens after entering recession, in eight out of the last 11 downturns, average job growth fell significantly in the six months before the start of recession compared with the prior six months.

In assessing recession risks, Paul Ashworth, chief U.S. economist for Capital Economics, primarily considered four indicators: payroll jobs, personal income, real business sales and industrial production. Aside from the decline in production, which has been weighed down by the strong dollar and the hard-hit energy sector, the rest are still growing at a healthy pace, he said.

“There is nothing to suggest that the U.S. expansion is in any peril,” he concluded.

Yet he and almost all other economists caution that the outlook could change quickly should there be a protracted fall in stock markets. U.S. stocks moved sharply lower after the Fed statement signaled renewed worries about the economic outlook while leaving the option of a second rate increase in March on the table. The Dow Jones industrial average closed down 1.4% and fell back to more than 10% lower than its late December level, a correction in Wall Street lingo. Oil prices, meanwhile, edged higher Wednesday, with U.S. crude futures rising 1.7% to $32.30 a barrel.

Economists reckon stocks were overvalued to begin with and would have to fall as much as another 10 percentage points before they seriously damage business and consumer confidence -- and the real economy.

Bill Rochelle, editor at large at the American Bankruptcy Institute, said that at the moment there’s not enough work to go around for all the insolvency lawyers and turnaround specialists. But he added that there are problem spots around the country -- for-profit education businesses, small shopping centers and over-leveraged retailers, among others. And Rochelle sees a glimmer of potentially more business for those who are trained to look for trouble.

Commercial bankruptcies, which had been dormant in recent years, ticked higher at the end of last year compared with the same period in 2014. “One or two months isn’t a trend,” he said. “We’ll have to wait and see.”

Twitter: @dleelatimes

ALSO:

Apple stock dives after iPhone sales’ growth slows dramatically

Lyft settles worker misclassification lawsuit for $12.25 million

Stocks claw higher after an early drop, helped by oil prices